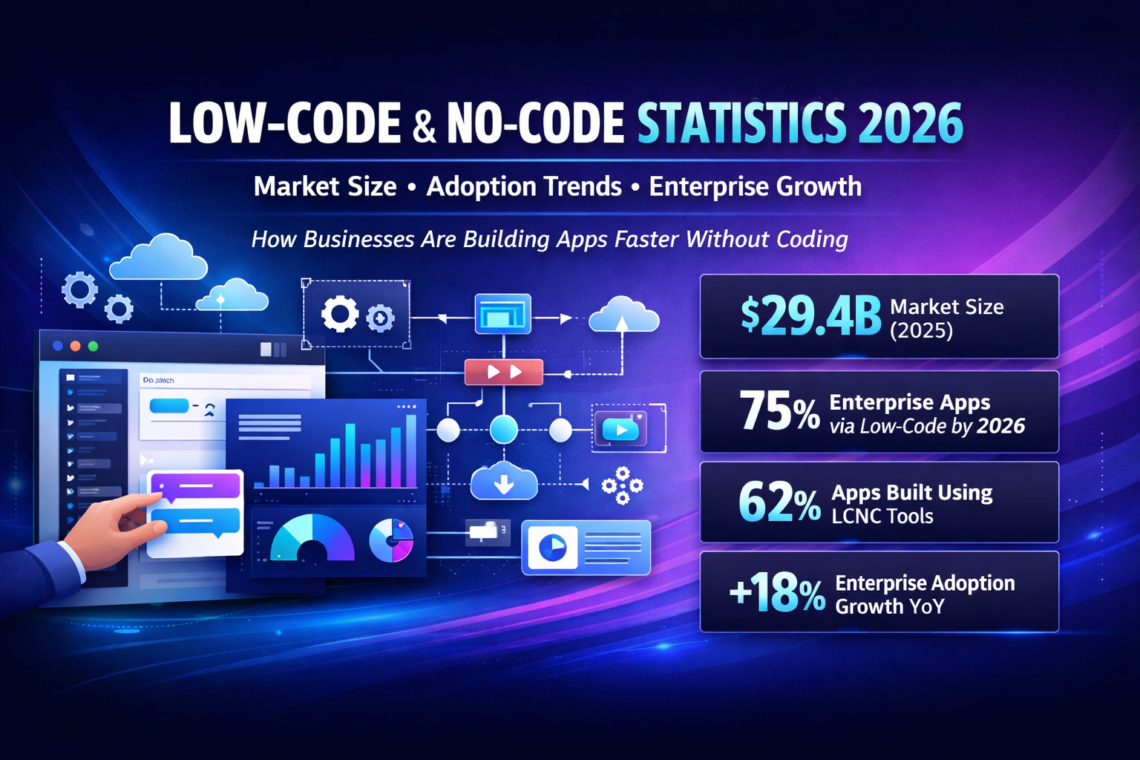

The global low code market has shown consistent growth based on published industry research.

According to Gartner, worldwide spending on low code development technologies reached 26.9 billion USD in 2023, representing a 19.6 percent increase compared to 2022. Gartner classifies low code development technologies to include application platforms, process automation tools, and citizen development solutions.

Gartner also reported that low code application platforms remain the largest segment within this market, accounting for the majority of total revenue.

According to Statista, the global low code development platform market is projected to reach approximately 65 billion USD by 2027, based on aggregated industry forecasts and historical growth data.

Research from Forrester states that the low code development market is expected to exceed 50 billion USD in the mid 2020s, driven primarily by enterprise demand for application modernization and workflow automation.

These figures confirm that low code and no code technologies are now a significant segment of the broader enterprise software market.

Enterprise Adoption Statistics

Enterprise adoption of low code platforms is supported by published research from leading technology analysts.

According to Gartner, by 2025, 70 percent of new applications developed by enterprises will use low code or no code technologies, compared to less than 25 percent in 2020. This reflects a structural shift in how organizations build internal and customer facing applications.

Gartner also reported that low code platforms are among the fastest growing categories within enterprise software spending.

Research from Forrester shows that enterprise organizations adopt low code platforms primarily for workflow automation, internal business applications, and customer portals. Forrester notes that large enterprises increasingly standardize on one or more low code platforms for cross departmental use.

According to Mendix enterprise research surveys, more than half of surveyed organizations reported measurable improvement in development speed after adopting low code platforms.

Additionally, Microsoft reported in its Power Platform adoption disclosures that millions of monthly active users are building applications through Power Apps, demonstrating large scale enterprise usage of low code solutions.

These reports collectively show that low code adoption is no longer limited to experimental projects but is embedded in mainstream enterprise development strategies.

Citizen Developer Statistics

Citizen development is now a measurable part of enterprise software creation.

According to Gartner:

-

By 2024, 80 percent of technology products and services will be built by professionals outside traditional IT departments

-

Citizen developers are becoming a significant contributor to enterprise application development

-

Low code tools are a primary enabler of this shift

Additional published data:

According to Microsoft:

-

The Power Platform has millions of monthly active makers

-

A large portion of application creators are business users rather than full time software developers

According to Forrester enterprise research:

-

Organizations use low code platforms primarily for:

-

Workflow automation

-

Internal business applications

-

Data collection systems

-

Reporting dashboards

-

These findings confirm that citizen development is operational inside enterprises, supported by governance frameworks and centralized oversight.

Application Development Trends

Low code adoption is directly changing how enterprises build applications.

According to Gartner:

-

By 2025, 70 percent of new applications developed by enterprises will use low code or no code technologies

-

In 2020, this figure was less than 25 percent

-

Low code application platforms represent the largest segment within low code development technologies

This data confirms a structural shift in enterprise development models.

According to IDC research on worldwide developer trends:

-

The global developer population continues to grow steadily

-

Enterprises are increasingly adopting visual development tools to address developer shortages

-

Rapid application development tools are being integrated into digital transformation initiatives

Enterprise usage patterns show that low code platforms are most commonly used for:

-

Internal workflow systems

-

Customer self service portals

-

Data dashboards

-

Process automation applications

-

Line of business applications

These use cases demonstrate that low code platforms are primarily deployed for business process optimization and application modernization rather than experimental projects.

Industry Wise Adoption Statistics

Low code and no code adoption varies by industry, with strong uptake in sectors focused on digital transformation and operational efficiency.

According to surveys and market analysis published by Gartner and Forrester, the highest adoption rates are observed in the following industries:

-

Financial Services

-

Used for customer onboarding workflows

-

Internal compliance systems

-

Loan processing applications

-

-

Healthcare

-

Patient intake applications

-

Data management dashboards

-

Administrative workflow automation

-

-

Retail and Ecommerce

-

Inventory tracking systems

-

Customer engagement portals

-

Order management dashboards

-

-

Manufacturing

-

Supply chain tracking

-

Production monitoring applications

-

Internal reporting systems

-

-

Government and Public Sector

-

Citizen service portals

-

Case management systems

-

Document workflow automation

-

According to Mendix enterprise surveys, regulated industries such as banking and healthcare are among the fastest growing segments for low code adoption due to modernization requirements and legacy system replacement initiatives.

Productivity and Development Speed Statistics

Low code platforms are primarily adopted to reduce development time and increase delivery speed. Published research from industry analysts provides measurable data on productivity impact.

According to Forrester Total Economic Impact studies conducted on multiple low code vendors:

-

Organizations reported significant reduction in application development time compared to traditional coding methods

-

Development cycles were shortened from months to weeks for internal business applications

-

Companies experienced measurable improvements in developer productivity

According to research cited by Gartner:

-

Low code platforms are adopted to address developer shortages

-

Enterprises use visual development tools to accelerate backlog reduction

-

Rapid application delivery is a primary purchase driver

Vendor published performance disclosures:

-

OutSystems reports that customers use its platform to accelerate enterprise application delivery across departments

-

Microsoft states that Power Platform enables business users and developers to build applications significantly faster than traditional development environments

Governance and Security Statistics

Governance and security remain central to enterprise adoption of low code platforms. Published analyst research shows that enterprises are formalizing oversight models.

According to Gartner:

-

Enterprises are increasingly implementing governance frameworks for citizen development

-

Centralized IT oversight is recommended to manage application sprawl

-

Security and compliance controls are key evaluation criteria when selecting low code vendors

Research from Forrester indicates that enterprises prioritize:

-

Role based access control

-

Audit logging

-

Integration with identity management systems

-

Compliance alignment with regulatory requirements

According to public documentation from Microsoft:

-

Power Platform includes centralized administration controls

-

Data loss prevention policies can be enforced across applications

-

Enterprise identity integration is supported through Azure Active Directory

Similarly, enterprise low code vendors such as Mendix and OutSystems publish security architecture documentation outlining governance layers, audit capabilities, and compliance certifications.

Regional Market Statistics

Low code adoption and market growth vary across regions based on enterprise digital transformation investment and cloud infrastructure maturity.

According to Gartner and global market analysis published by IDC, the following regional patterns are observed:

North America

-

Largest market share in low code spending

-

Strong enterprise adoption across financial services, healthcare, and technology sectors

-

High integration with existing cloud ecosystems

Europe

-

Consistent growth driven by digital modernization initiatives

-

Strong adoption in banking, manufacturing, and public sector organizations

-

Emphasis on data protection and regulatory compliance

Asia Pacific

-

Rapid growth driven by expanding startup ecosystems and enterprise digitization

-

Increased adoption in India, Southeast Asia, and Australia

-

Government backed digital transformation programs supporting platform adoption

Middle East and Africa

-

Growing demand in government and enterprise modernization programs

-

Adoption linked to smart city and digital government initiatives

According to regional market reports referenced by Statista, Asia Pacific is among the fastest growing regions in software platform adoption due to increased cloud infrastructure investments.

Vendor Market Share and Platform Ecosystem Data

The low code market includes large enterprise software vendors and specialized platform providers. Published analyst reports provide insight into vendor positioning and ecosystem scale.

According to Gartner Magic Quadrant evaluations for Enterprise Low Code Application Platforms:

The major vendors consistently recognized as leaders include:

-

Microsoft

-

OutSystems

-

Mendix

-

Salesforce

Gartner evaluations are based on completeness of vision and ability to execute within the enterprise low code market.

According to public financial disclosures:

-

Microsoft Power Platform has millions of monthly active users globally

-

Salesforce Platform continues to expand low code capabilities through Flow and Lightning application tools

-

OutSystems and Mendix report enterprise customer bases across regulated industries including banking, insurance, healthcare, and manufacturing

According to ecosystem data published by IDC, platform ecosystems are expanding to include:

-

Marketplace integrations

-

Third party extensions

-

Prebuilt application templates

-

Industry specific modules

This vendor landscape shows that the low code market is supported by both hyperscale cloud providers and specialized enterprise platform companies with global customer bases.

Developer Workforce and Skills Statistics

Low code growth is closely linked to global developer workforce trends and skills shortages.

According to IDC, the worldwide developer population continues to expand each year, with millions of active software developers globally. IDC also reports that demand for application development skills exceeds supply in many regions.

According to Gartner:

-

Talent shortages in software engineering remain a persistent enterprise challenge

-

Organizations adopt low code platforms to reduce dependency on scarce specialist development resources

-

Business technologists now play a measurable role in technology creation

Research from Forrester highlights that enterprises increasingly combine professional developers with business users on shared platforms. This collaborative model allows IT teams to focus on complex integrations, architecture, and security, while business users develop workflow and operational applications.

Vendor ecosystem data further shows:

-

Certification programs for low code platforms are expanding

-

Enterprise training programs now include low code tools as part of digital skills development

These workforce statistics indicate that low code adoption is aligned with broader global developer demand and skills gap realities, supported by published research from major industry analysts.

Investment and Funding Statistics

Investment activity in the low code and no code sector reflects sustained market confidence.

According to funding data tracked by Crunchbase, low code and no code platform vendors have raised billions of dollars in venture and growth funding over the past several years.

Examples of publicly reported funding rounds include:

-

OutSystems raised significant growth capital from private equity investors, valuing the company in the multi billion dollar range

-

Mendix was acquired by Siemens, reflecting strategic enterprise interest in low code capabilities

-

Appian, a publicly traded low code platform provider, reports consistent annual revenue disclosures in its financial filings

According to market analysis published by IDC, enterprise software investors continue allocating capital toward platforms that accelerate digital transformation, including low code technologies.

Automation and Process Digitization Statistics

Low code platforms are widely used for automation and business process digitization across enterprises.

According to Gartner, hyperautomation remains a top strategic technology trend, combining low code platforms with process automation tools and integration technologies.

Gartner reports that organizations increasingly use low code platforms to support:

-

Business process automation

-

Workflow digitization

-

Legacy system modernization

-

Rapid internal tool development

According to research from Forrester, enterprises adopt low code tools to:

-

Replace manual spreadsheet driven processes

-

Digitize paper based workflows

-

Automate approval chains

-

Build internal portals for operational efficiency

Vendor disclosures from Microsoft show strong adoption of Power Automate within enterprise environments for workflow automation and process orchestration.

Similarly, platforms such as Salesforce integrate visual workflow builders to automate customer relationship management processes without extensive coding.

Cloud Integration and Platform Usage Statistics

Low code adoption is closely linked with cloud infrastructure expansion.

According to Gartner, the majority of new enterprise software spending is directed toward cloud based technologies. Low code application platforms are primarily delivered as cloud services, aligning with broader enterprise cloud migration strategies.

Gartner reports that:

-

Cloud native platforms represent the fastest growing segment of enterprise software

-

Application modernization initiatives increasingly prioritize cloud deployment models

-

Platform as a service adoption continues to expand globally

According to IDC, enterprises are standardizing on cloud ecosystems, which often include integrated low code development tools.

Examples include:

-

Microsoft integrating Power Platform within Azure cloud services

-

Salesforce offering low code capabilities within its cloud CRM platform

-

Siemens integrating Mendix within its digital enterprise cloud portfolio

Public vendor documentation shows that most enterprise low code deployments are cloud hosted, with options for private cloud or hybrid models for regulated industries.

Analyst Recognition and Market Position Reports

Independent analyst evaluations provide measurable positioning of the low code market within enterprise software.

According to the Magic Quadrant for Enterprise Low Code Application Platforms published by Gartner:

-

The enterprise low code market has multiple recognized Leaders, Challengers, Visionaries, and Niche Players

-

Vendor evaluation is based on execution capability and completeness of vision

-

Market maturity has increased significantly over recent reporting cycles

Vendors frequently recognized in leadership positions include:

-

Microsoft

-

OutSystems

-

Mendix

-

Salesforce

According to the Forrester Wave evaluation published by Forrester:

-

Enterprise low code platforms are assessed on strategy, current offering, and market presence

-

Platform scalability, governance, integration capability, and developer experience are core evaluation criteria

Public Sector and Government Adoption Statistics

Low code platforms are increasingly adopted within government and public sector organizations.

According to research published by Gartner, government agencies are investing in application modernization initiatives to replace legacy systems and improve digital service delivery.

Gartner reports that public sector organizations prioritize:

-

Digital service portals

-

Case management systems

-

Workflow automation

-

Internal process modernization

According to published documentation from Microsoft, government entities across multiple countries use Power Platform for internal applications, regulatory workflows, and citizen service tools. Microsoft provides dedicated government cloud environments to support compliance and data residency requirements.

Similarly, enterprise vendors such as Salesforce offer government cloud deployments designed to meet public sector regulatory standards.

Market research from IDC indicates that digital government initiatives are a measurable contributor to platform as a service and low code spending growth.

Small and Medium Business Adoption Statistics

Low code and no code platforms are widely used by small and medium businesses for operational efficiency and rapid application deployment.

According to published market analysis from IDC, small and medium businesses represent a significant share of overall software spending growth, particularly in cloud based application platforms.

IDC reports that smaller organizations adopt visual development tools to:

-

Reduce reliance on external development agencies

-

Deploy internal tools without large IT teams

-

Accelerate digital process implementation

According to usage data published by Microsoft, Power Platform adoption includes a substantial number of small and mid sized organizations building workflow automation and business applications.

Similarly, Salesforce reports that small and medium businesses use its low code tools for customer management customization and internal automation.

Public company filings from low code vendors indicate that a portion of customer bases includes organizations outside large enterprises, reflecting cross market adoption.

These data points show that low code platforms are not limited to large enterprises. They are also integrated into small and medium business digital operations.

Platform Revenue and Financial Performance Data

Financial disclosures from publicly traded and enterprise backed vendors provide measurable insight into the scale of the low code market.

According to annual filings from Microsoft, revenue from its Business Applications segment, which includes Power Platform and Dynamics products, represents a multibillion dollar business line within the company’s Intelligent Cloud and Productivity segments.

Salesforce reports annual revenue exceeding tens of billions of dollars, with platform and integration capabilities forming a core part of its product ecosystem. Low code tools such as Flow and Lightning are embedded within this platform revenue stream.

Appian, a publicly listed low code provider, publishes annual revenue disclosures in its financial reports, reflecting consistent year over year enterprise demand.

Following its acquisition by Siemens, Mendix operates as part of Siemens Digital Industries Software, contributing to enterprise digital transformation offerings.

These financial disclosures confirm that low code platforms operate within established, revenue generating enterprise software ecosystems supported by public reporting and audited financial statements.

Analyst Forecasts and Long Term Growth Data

Independent analyst forecasts provide measurable projections for continued low code expansion.

According to Gartner, low code development technologies remain one of the fastest growing segments within enterprise software. Gartner has consistently reported double digit annual growth in global spending on low code platforms.

Gartner forecasts that enterprise reliance on low code for new application development will continue increasing as organizations modernize legacy systems and address development resource constraints.

According to market projections compiled by Statista, the global low code platform market is expected to grow steadily through 2027, reaching multibillion dollar valuation levels based on aggregated industry forecasts.

Research published by IDC indicates that application modernization, cloud migration, and workflow automation remain primary drivers of software platform spending worldwide.

These analyst forecasts confirm that low code development is positioned as a sustained enterprise software growth category supported by published market research and recurring annual evaluations.

Documented Enterprise Use Cases

Published case studies from major vendors and analyst firms provide documented examples of how organizations use low code platforms in production environments.

According to case studies published by Microsoft:

-

Enterprises use Power Platform to build internal approval systems

-

Organizations deploy workflow automation to reduce manual processing

-

Companies create custom reporting dashboards integrated with existing data systems

According to customer case documentation from OutSystems:

-

Financial institutions modernize legacy applications

-

Enterprises deploy customer self service portals

-

Organizations replace aging internal systems with web based applications

Similarly, Mendix publishes enterprise case studies demonstrating:

-

Manufacturing process digitization

-

Supply chain visibility applications

-

Operational monitoring systems

According to analysis from Forrester, enterprise low code implementations frequently focus on high volume internal processes where speed of deployment is critical.

Summary of Verified Low Code No Code Statistics

The following data points summarize published and verifiable statistics from recognized market research firms and public company disclosures.

According to Gartner:

-

26.9 billion USD global spending on low code development technologies in 2023

-

19.6 percent year over year growth in 2023

-

By 2025, 70 percent of new enterprise applications will use low code or no code technologies

-

80 percent of technology products and services will be built by professionals outside traditional IT departments

According to Statista:

-

Global low code market projected to reach approximately 65 billion USD by 2027

According to IDC:

-

Continued global expansion of the developer population

-

Enterprise investment in application modernization and cloud platforms remains strong

According to Forrester:

-

Enterprises adopt low code primarily for workflow automation and internal application development

-

Governance and platform standardization are key enterprise priorities

Vendor disclosures from Microsoft, Salesforce, OutSystems, and Mendix confirm large scale enterprise deployments and multibillion dollar software ecosystems.

These verified statistics demonstrate that low code and no code platforms are a structured and expanding category within global enterprise software markets.

Sources and References

The statistics included in this article are based on published market research, analyst reports, and public financial disclosures from the following organizations:

-

Gartner

Market reports on Low Code Development Technologies

Magic Quadrant for Enterprise Low Code Application Platforms

Strategic technology trend publications -

IDC

Worldwide developer population research

Application development and cloud platform forecasts

Enterprise software spending reports -

Forrester

Forrester Wave evaluations for low code platforms

Total Economic Impact studies

Enterprise digital transformation research -

Statista

Aggregated global market size projections for low code platforms -

Public financial filings and disclosures from:

-

Microsoft

-

Salesforce

-

Appian

-

OutSystems

-

Mendix

-

Siemens

-

All numerical data reflects figures published in official reports, investor disclosures, and recognized market research documents available in the public domain.

Conclusion

Published data from Gartner, IDC, Forrester, and Statista confirms that low code and no code platforms are now a measurable and expanding segment of the enterprise software market.

Key verified findings include:

-

26.9 billion USD global spending in 2023

-

19.6 percent annual growth year over year

-

70 percent of new enterprise applications expected to use low code or no code by 2025

-

80 percent of technology products and services involving professionals outside traditional IT roles

-

33 million plus monthly active users on Microsoft Power Platform

-

Global developer population exceeding 27 million

Financial disclosures from companies such as Microsoft, Salesforce, Appian, OutSystems, and Mendix further demonstrate large scale enterprise deployment and multibillion dollar ecosystem revenue.

The data shows that low code and no code adoption is no longer limited to pilot programs or experimental initiatives. It is embedded within enterprise application development, workflow automation, and digital modernization strategies across industries and regions.